Price to Earnings Multiple and Stock Selection: Evidence from Malaysian Listed Firms

Keywords:

Price to earnings multiple, value stock, growth stock, MalaysiaAbstract

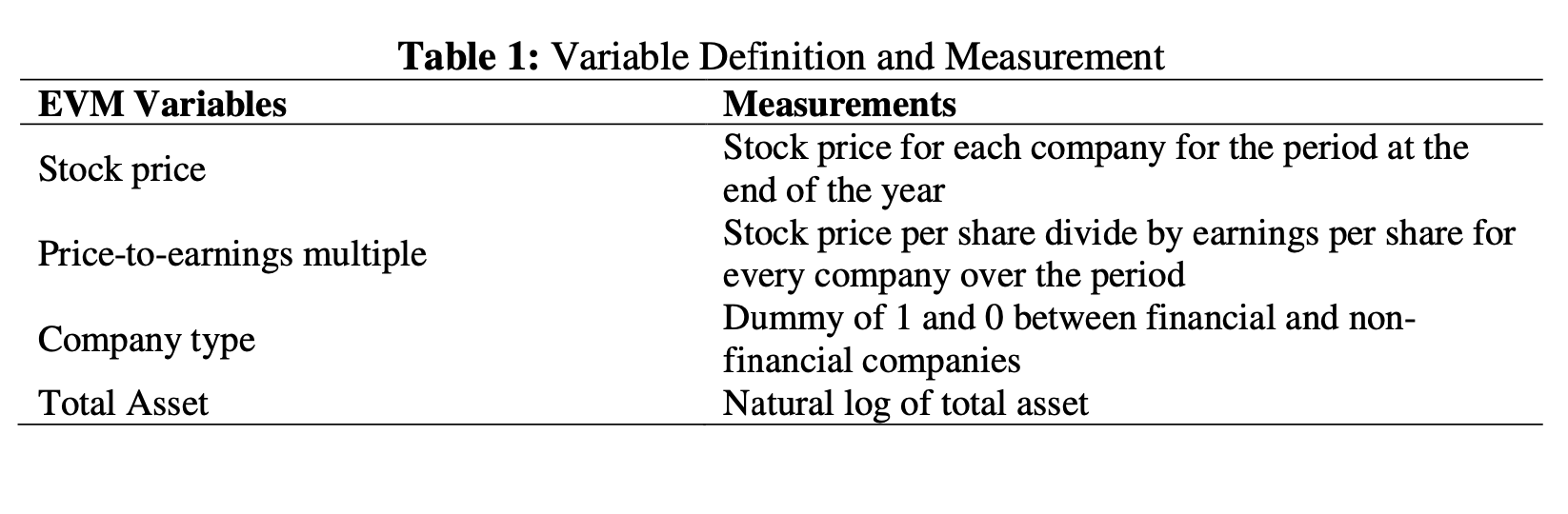

Selection of appropriate portfolio for investment is an issue of great concern amongst investors across the globe. Investors have to choose between stocks that are highly price (growth stock) by the market and stocks undervalued by the market (value stocks). This research investigated the influence of price to earnings PE multiple in predicting the value of growth and value securities. The study utilized data of 233 randomly selected listed firms in Malaysia covering the period of 2008-2013. Pooled Ordinary Least Square OLS was used to estimate the regression however failed to satisfy the post estimation tests. Then random effect and fixed effect models are used to estimate the regression and selection test between the models favoured the random effect model. The results reveals a significant positive relationship between price to earnings multiple and the stock returns. The implication is that, growth stocks provide higher stock returns compared to the value stock. The low R2 suggests that prediction of stock returns is not only determined by price to earnings multiple, but, by combination of various factors.