Empirical Evidence on the SMEs Risks Framework in Malaysia

Keywords:

SME risk, risk management, takaful, micro enterprisesAbstract

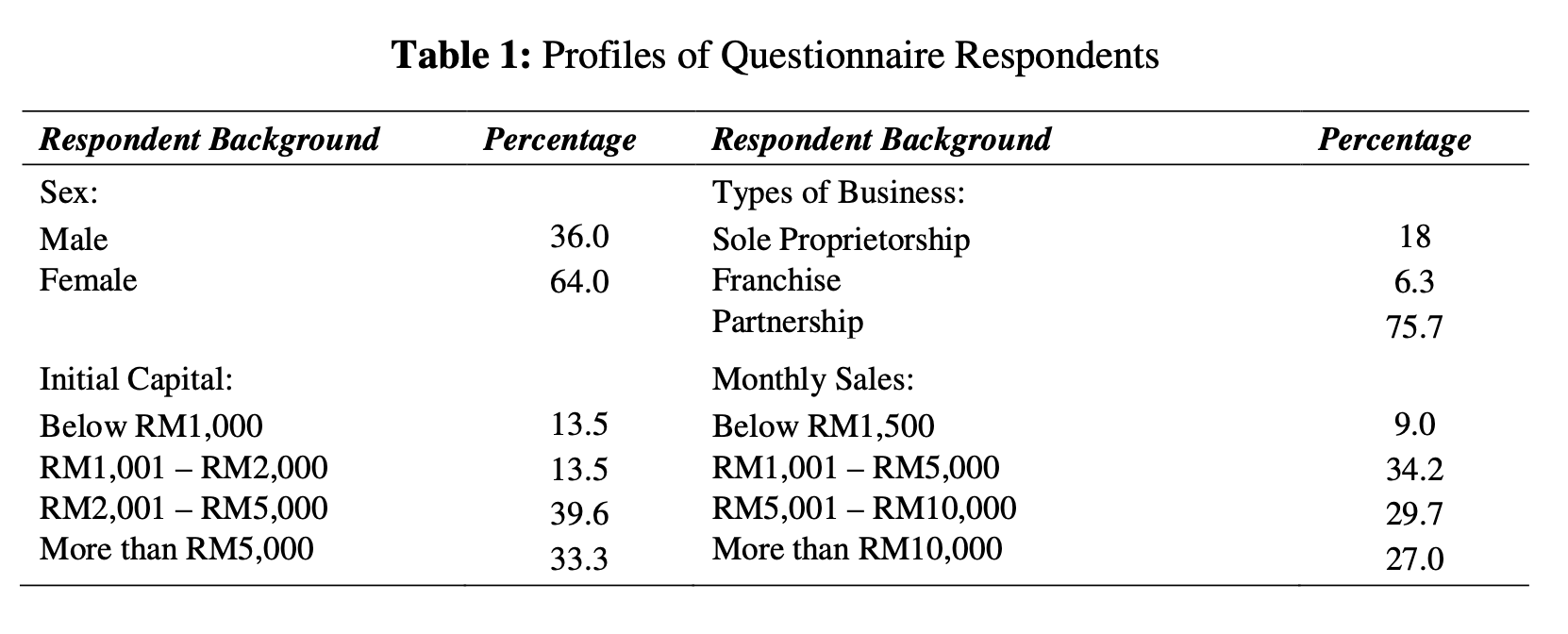

The aim of this study is to propose a SMEs risk framework which eventually will be used to develop an appropriate takaful scheme to minority groups. The framework encompasses four critical elements: financial, operational, compliance and strategic risk. A complete survey questionnaire has been collected from 111 micro enterprises located in the state of Johor. Factor analysis was employed to identify the most important risks of takaful products, emphasizing the benefits and expectations, as perceived by the micro enterprises. A confirmatory factor analysis using structural equation modeling (SEM) was conducted to support the concept of SMEs risk. The results indicate that model 2 (four correlated factor) outperformed model 1 (one factor model). The proposed framework is beneficial for takaful operators to introduce a suitable and a marketable takaful scheme that meant for micro enterprises.