Capital Structure and Performance of Malaysia Plantation Sector

Keywords:

Capital structure, firm performance, Bursa MalaysiaAbstract

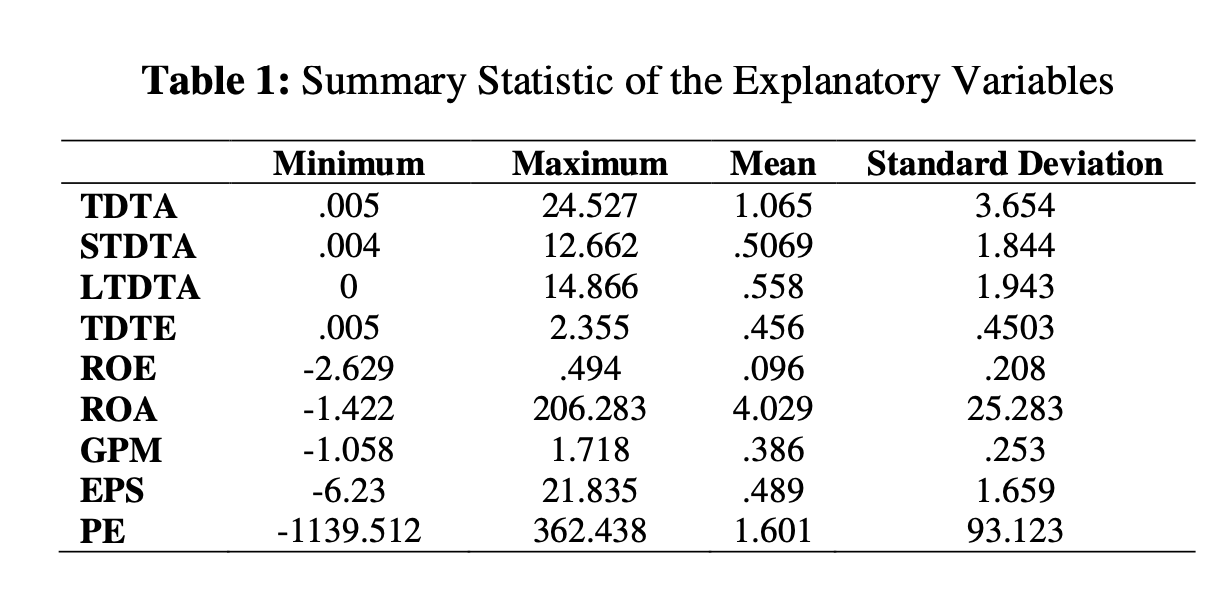

This paper investigates the relationship between capital structure and firm performance. The sample of this study is 41 listed companies in Bursa Malaysia from year 2007 to year 2011. This study uses four capital structure measures as independent variables which are short-term debt to total assets (STDTA), long-term debt to total assets (LTDTA), total debt to total assets (TDTA) and total debt to total equity (TDTE). Another five firm performance as dependent variables which are return on equity (ROE), return on assets (ROA), gross profit margin (GMS),earnings per share (EPS) and price earnings (PE). Capital structure variable which measured by total debt to total assets (TDTA), short- term debt to total assets (STDTA) and long-term debt to total assets (LTDTA) have significant positive relationships with return on equity (ROE), return on assets (ROA); and significant negative relationships with gross profit margin (GPM). However, capital structure which measured by total debt to total equity (TDTE) have significant positive relationships with return on equity (ROE) and significant negative relationships with gross profit margin (GPM) and return on assets (ROA). Total debt to total equity (TDTE) has a significant influence on return on equity (ROE) and price earnings (PE). While, total debt to total assets (TDTA) and total debt to total equity (TDTE) are significantly influenced return on assets (ROA). Gross profit margin (GPM) is significantly influenced by three independent variables which are total debt to total equity (TDTE), total debt to total assets (TDTA) and short-term debt to total assets (STDTA). Earnings per share (EPS) is significant influence by total debt to total assets (TDTA) and short term debt to total debt (STDTA). In sum, the results show that there is a relationship and significant influence between capital structure and corporate performance in Malaysia plantation sector firms.