Impact of Capital Investment on Working Capital Management

Keywords:

Capital investment, working capital management, net liquidity balance, working capital requirementAbstract

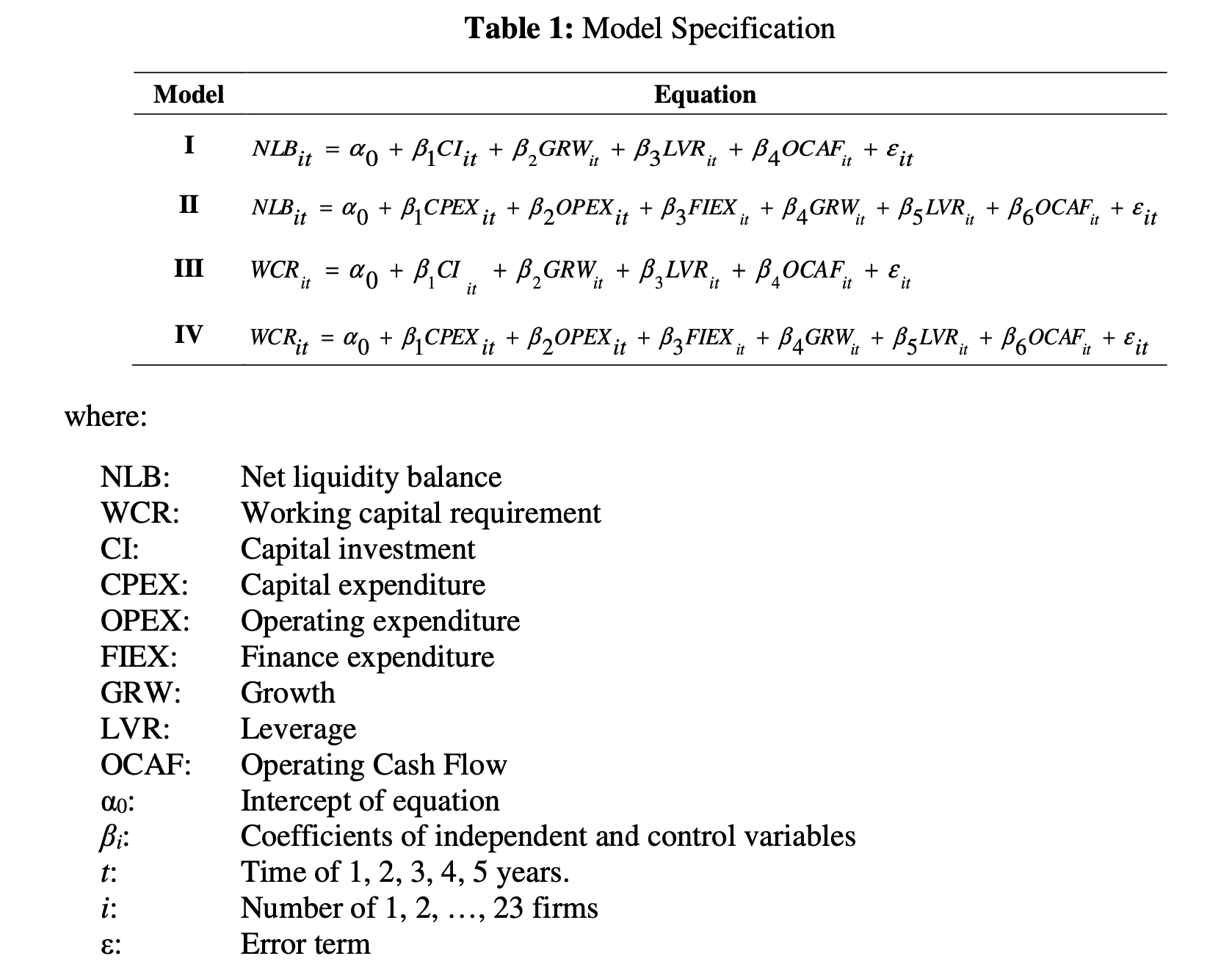

Working capital management is the mechanism to achieve balance between current assets and current liabilities of firm to meet the maturing obligations and the fixed assets are properly serviced. This paper investigates the impact of capital investment on working capital management across Malaysian technology firms from 2007 to 2011. Proxies of working capital management are the net liquidity balance and working capital requirement, instead of the traditional financial ratios. Panel data analysis and robust regression techniques result of 115 observations shows capital investment impact net liquidity balance negatively. On the other hand, significant positive impact of capital investment on working capital requirement identified. This signifies that firms capital investment promote the working capital requirement to ascertain the firm’s liquidity level and simultaneously creates value from liquid assets. Leverage is the strong substitute for net liquidity balance capitalization that increases the influence of financial expenditure-net liquidity balance relationship. Hence, working capital management is dependent on capital investment in Malaysian technology firms, which indicates that long-term investment decision does influence short-term financial management.