Intelligent Forecasting Based on Long-Short Term Memory

Keywords:

Intelligent forecasting, stock markets, long short term memory (LSTM) analysis, machine learningAbstract

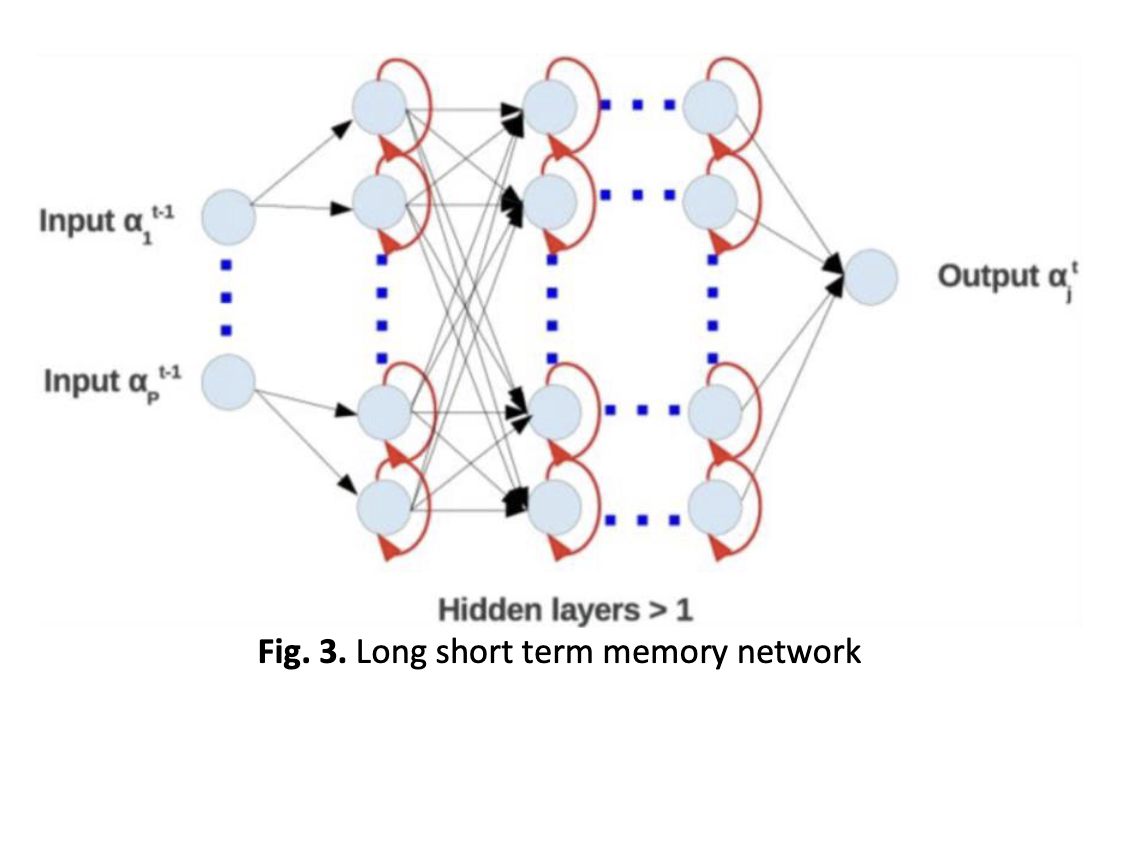

Stock markets are non-linear, and stock market research has become an important topic. Usually, people invest in the stock market based on traditional methods, such as fundamental and technical analysis. In the stock market prediction prices, various tricks and tools are used to minimize the risk, at the same time increase the profits. Forecasting is crucial in the stock market, especially in business which the prediction algorithm can be very complicated and necessitating. Alternatively, the traditional analysis may not guarantee the solid outcome of the stock analysis. For the prediction, Long Short Term Memory (LSTM) analysis is mainly used. This work examines the efficiency of machine learning and predicts stock market prices. This paper also proposes finding the most ideal variables by producing the least Mean Absolute Percentage Error (MAPE).

Downloads