Cause and Effect of the Emerging Chinese Car in the Indonesian Automotive Industry

Keywords:

Chinese car, Indonesian automotive industry, Japanese cars, market performance, market shareAbstract

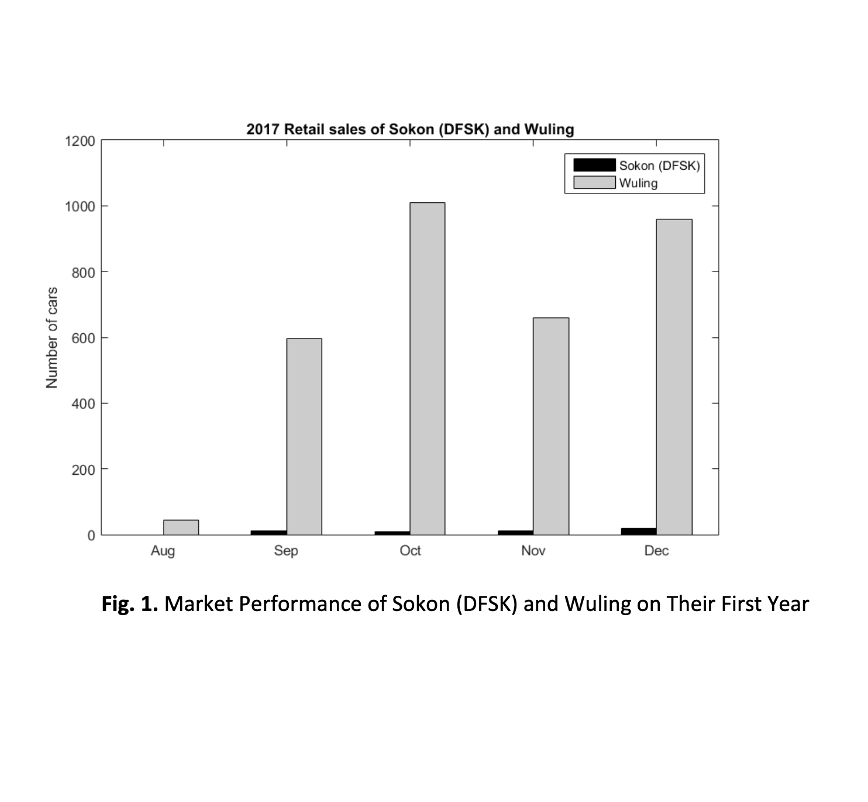

Japanese cars have been dominating Indonesian automotive industry since 1970s. Several European and American carmakers have challenged them. Furthermore, most recent new contenders such as the Korean and Malaysian with their strong brand including Hyundai, Kia and Proton have also taken part in the rivalry. However, all fail to conquer the automotive market in the biggest south-east Asia's economy. The introduction of Chinese brands i.e. Wuling and Sokon to the Indonesian market in 2017 brought significant change in the competition landscape of Indonesian automotive industry. This article aims to analyse both Wuling and Sokon market performance compared to other Japanese carmakers. Comprehensive discussion regarding the existing dominant Japanese brands were firstly presented. To analyse the positioning of Chinese brands, data was collected from GAIKINDO with retail sales being considered in this study. The wholesales data was not presented as it does not reflect the actual market performance of an automobile brand. This study found that both Wuling and Sokon had significant market performance during their two years existence in Indonesia. In their second year, Wuling made into the top ten car manufacturers with 1.3% market share (9th), while Sokon had 0.1% market share (13th). Profound and deep analysis why both Chinese automobile brands could penetrate successfully into the fierce competition of Indonesian automotive market was given. This could be valuable lessons for non-Japanese brands such as Proton and other brands to enter the Indonesian automotive market successfully. In brief, three factors contribute to the success of Chinese automobile market performance in Indonesia; (1) the new image of “Made in China” initiated by electronic companies such as Huawei and Xiaomi, (2) the change of marketing trend and downfall of traditional dealership and (3) the rise of Indonesian YouTube car reviewer.