Effect of Board Size and Board Composition on Firm Performance in Nigerian Petroleum Marketing Industry

Keywords:

Evidence, effect, board size, board composition, firm performance, corporate governanceAbstract

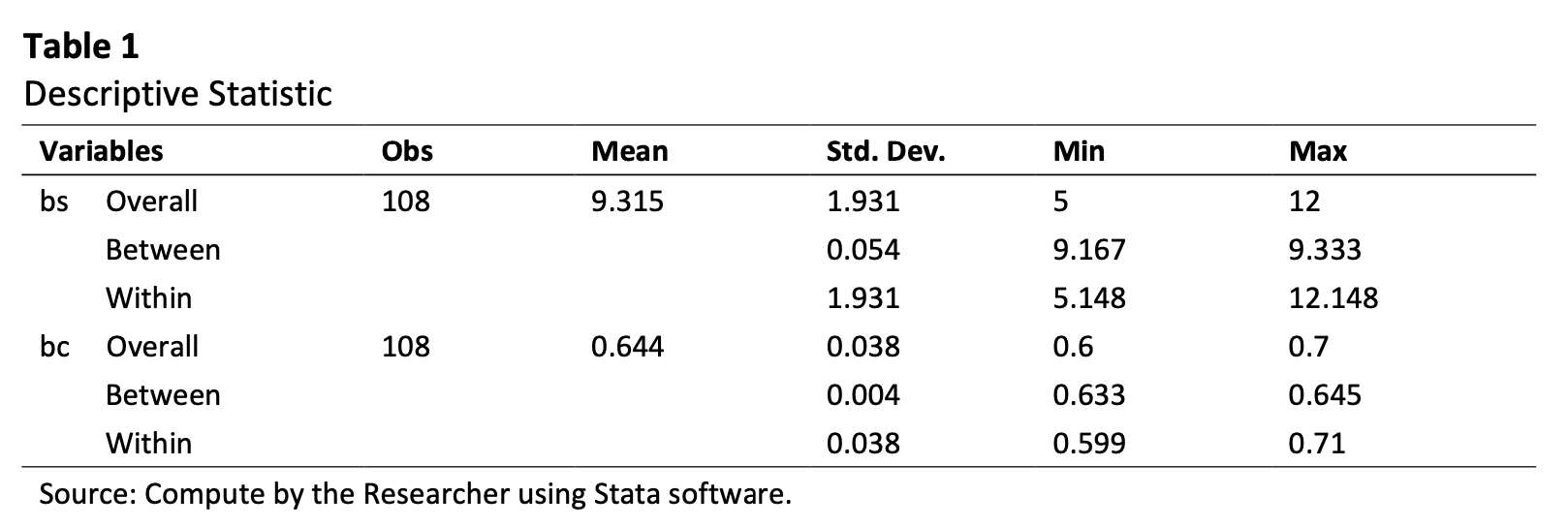

Corporate governance is the mechanisms, process and relations by which corporations are controlled and directed. Governance structures and principles identify the distribution of rights and responsibilities among different participants in the corporation such as the board of directors, managers, shareholders, creditors, auditor’s regulators and other stakeholders and also includes the rules and procedures for making decisions in corporate affairs. Corporate governance includes the processes through which corporation’s objectives are set and pursued in the context of the social, regulatory and market environment. In theory, the board is responsible to the shareholders and is supposed to govern a company’s management. But in many instances, the board has become a servant of the chief executive officer (CEO), who is typically also the chairman of the board. The study aims to investigate the relationship between corporate governance mechanisms and firm financial performance of the Nigerian petroleum marketing industry. For the study goal data was collected from financial statement of 6 sample companies from 2004-2014. The study utilized three variable including board size, board composition as the independent variables, in addition return on equity (ROE) was chosen as firm financial performance measurement in other word dependent variable of the study. The researchers utilized secondary wellspring of data with the end goal of this study. Ten years (2004 – 2014) yearly reports and records of the examined organizations were gotten from significant sources, (Nigerian stock exchange, all African sites and sample companies domain), data extracted from financial statement and notes to the financial statement of the sample companies of the Nigerian petroleum marketing industries. The result found that, board size is negatively related to return on equity while the relationship between board composition with ROE is positive but not significant.