Sales Tax Compliance Model for the Jordanian Small and Medium Enterprises

Keywords:

ales tax compliance, Fischer’s model, public governance, patriotismAbstract

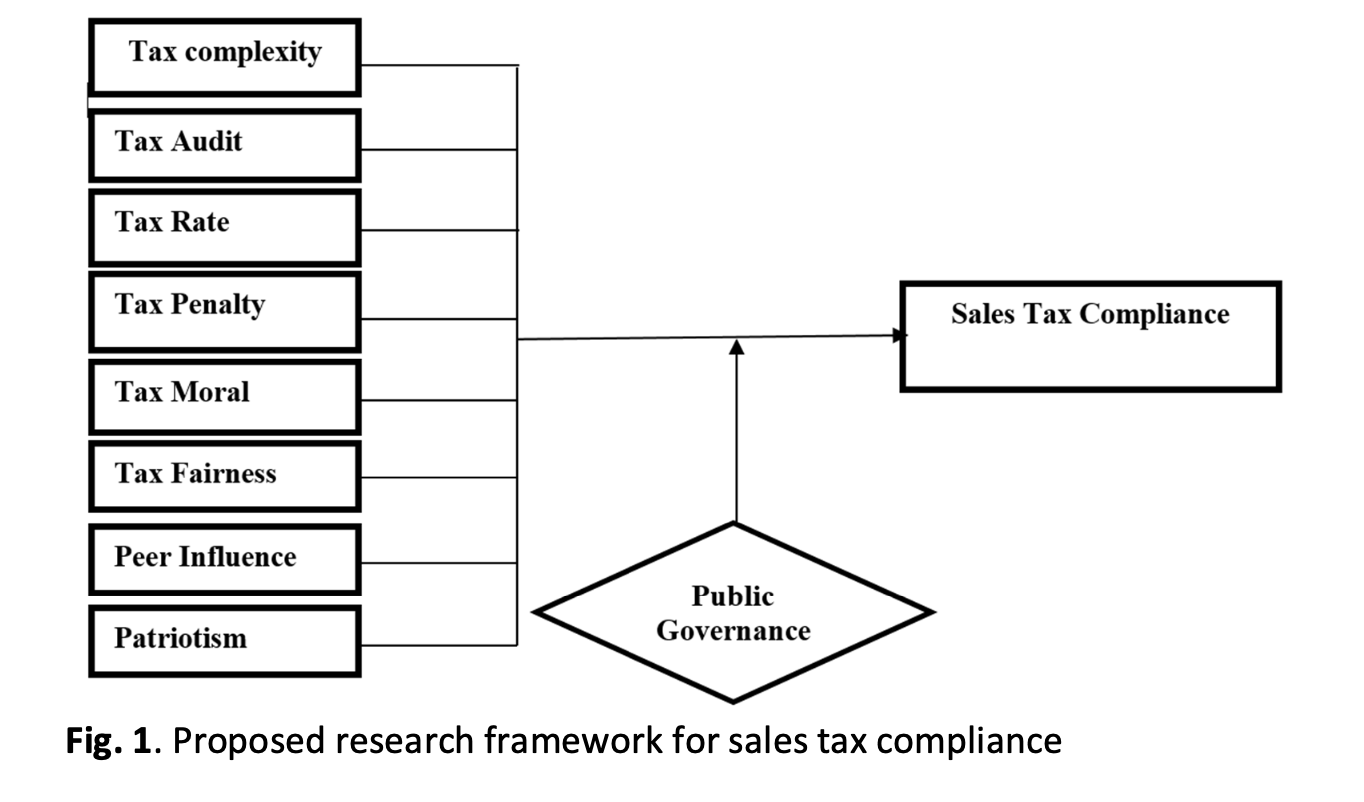

Despite the various fiscal measures recently undertaken by the Jordanian government to increase the domestic revenue, the reports of annual budget demonstrate that Jordan is challenged by a sharp rise in net public debt and fiscal deficit with the increase in tax non-compliance, specifically in sales tax. Therefore, the issue of sales tax non-compliance needs a serious focus in Jordan. Though several studies were conducted on income tax compliance, studies on sales tax compliance have received less attention. Various factors lead to non-compliance; however, the basic model of tax compliance itself is not sufficient to explain the phenomenon comprehensively. In order to obtain an in-depth understanding of the factors influencing sales tax compliance among the small and medium enterprises (SMEs) in Jordan, the authors proposed an extension to the Fischer’s model of tax compliance by incorporating patriotism and public governance as a new independent and moderating variables respectively. Prior studies on tax compliance are yet to examine the influence of patriotism on sales tax compliance. This paper also argues theoretically that the sales tax compliance is likely to be moderated by the role of public governance. This proposition could improve better understanding of sales tax compliance behavior among SMEs.