From Homemaking to Money Making: A Mixed-Methods Exploration of Financial Literacy Empowerment in Women’s Home-Based Entrepreneurial Ventures

DOI:

https://doi.org/10.37934/arbms.36.1.4354Keywords:

Women entrepreneurs, financial literacy, home-based businesses, entrepreneurial journey, gender empowermentAbstract

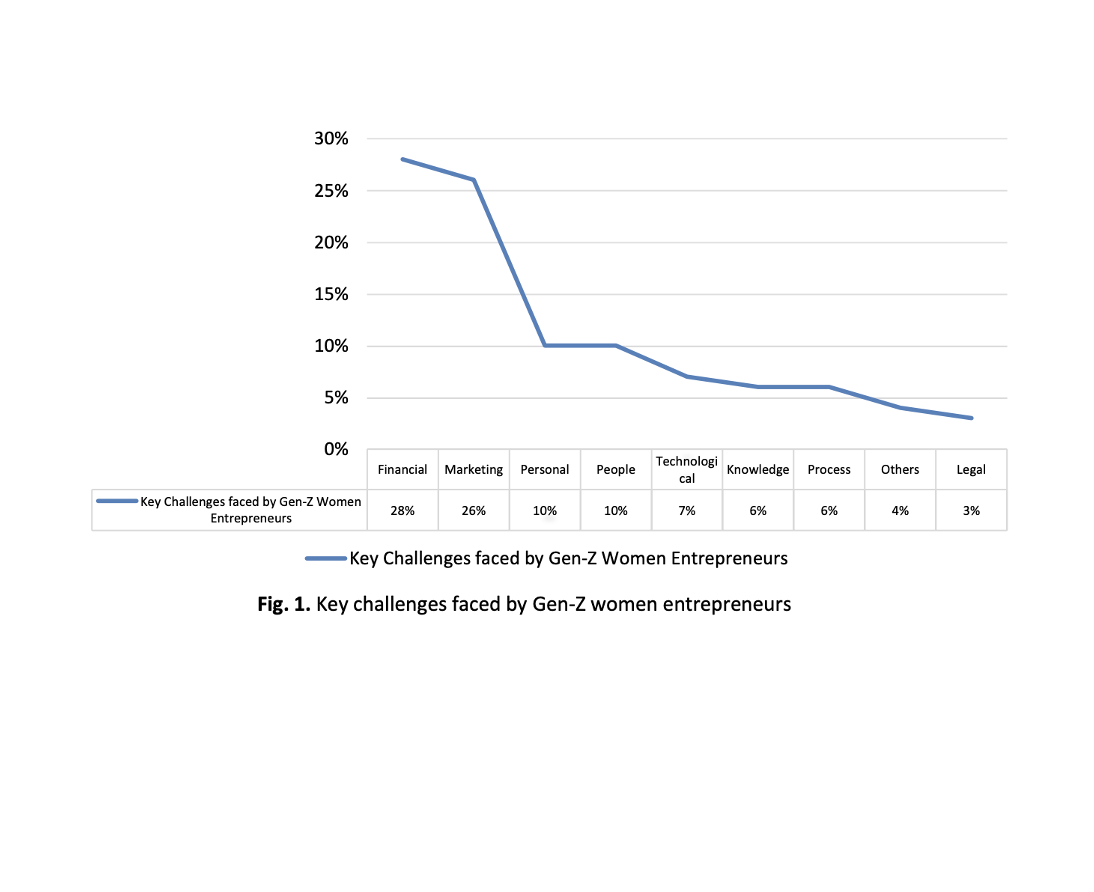

This study delves into the transformation of women entrepreneurs as they shift from traditional homemaking rules to establishing successful home-based business. With a notable rise in women embracing entrepreneurship from home, “From Homemaking to Money Making” explores this multifaceted journey, emphasizing the crucial role of financial literacy. The investigation aims to uncover how financial literacy acts as a catalyst, empowering women to navigate the intricacies of entrepreneurship within their homes. Despite the recognized importance of financial literacy in entrepreneurship, a significant gap exists in understanding the specific challenges faced by women transitioning from home making to entrepreneurship. The research landscape lacks a focused exploration of how financial literacy serves as a dynamic force, equipping women with skills to make inform decision, efficiently manage resources, and sustain profitable home-based enterprises. Employing a mixed-methods approach, including qualitative interviews and quantitative surveys, the study involves women entrepreneurs who successfully navigated the transition from homemaking to money-making ventures. By extracting valuable insights into their experiences, challenges, and the perceived impact of financial literacy, the research aims to illuminate the correlation between financial literacy and the success of women entrepreneurs. Preliminary findings highlight the essential skills acquired through financial education, including effective budgeting, strategic financial decision-making, and proficient cash flow management. In conclusion, "From Homemaking to Money Making" underscores the transformative role of financial literacy in the entrepreneurial journey of women from home. The study advocates for ongoing initiatives to integrate financial education into support programs for aspiring women entrepreneurs, promoting economic empowerment and challenging established gender norms.