The Roles of Insurance on Economic Growth in Malaysia: An ARDL Approach

DOI:

https://doi.org/10.37934/arbms.36.1.113Keywords:

Life insurance, non-life insurance, economic growth, ARDL, ECMAbstract

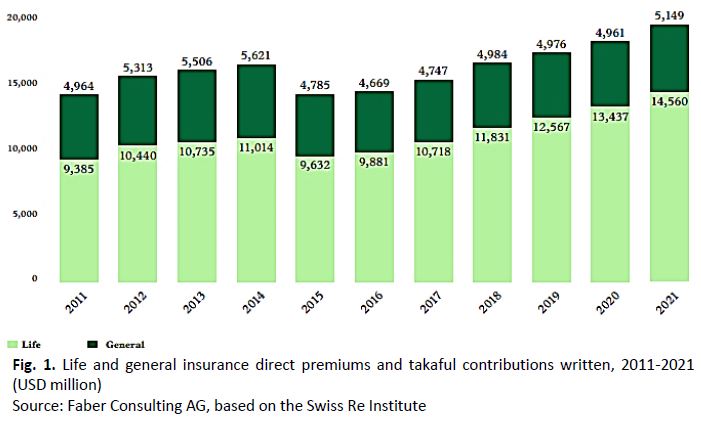

Malaysia’s economic growth has been rising steadily over the years and one of the main contributors is the insurance sector. The literature has recorded mixed findings on the relationship between insurance and economic growth. This paper examines the relationship between the insurance sector and economic growth in Malaysia over an extended period of 1990-2021. This paper uses three proxies for the insurance sector i.e. life insurance premiums, nonlife insurance premiums, and total insurance premiums. The Autoregressive-Distributed Lag (ARDL) and Error Correction Model (ECM) approaches are employed to achieve the objective. While controlling for foreign direct investment, export, and import, this paper found that there is a positive long-run relationship between non-life insurance premiums and economic growth. Conversely, a negative short-run relationship is observed between life insurance premiums and economic growth. The total insurance premium has a negative short-run relationship with economic growth yet is insignificant for the long-run. The non-life insurance sector has a larger contribution compared to life insurance on Malaysia's economic growth as the market depends more on capital formation and investments, particularly in infrastructure, real estate, and capital markets. The insurance sector provides financial expansion in terms of payment for protection which results in an economic boost.