2007-2009 Global Financial Crisis and Malaysian Banks Profitability: An Empirical Analysis

Keywords:

2007 global financial crisis, Malaysian banks, bank profitabilityAbstract

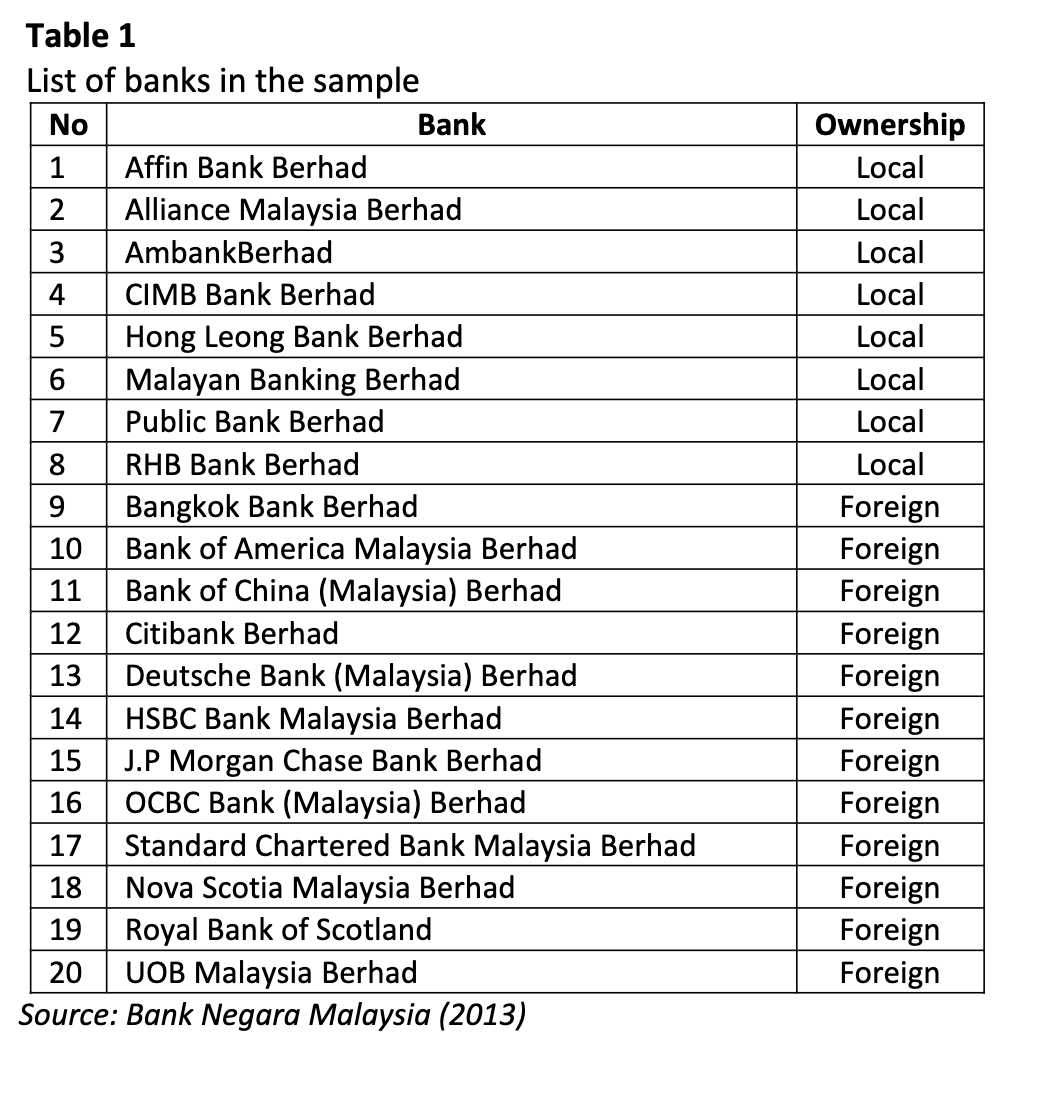

This study explores the impact of 2007-2009 global financial crisis on Malaysian bank

profitability and examines bank-specific and macroeconomic determinants of bank

profitability for the period 2006 to 2012. The results reveal that the 2007-2009 global

financial crisis does not give an impact on Malaysian bank profitability, suggesting that

Malaysia has a sound banking system that insulated them from the crisis. The findings

also show that bank capital, credit risk and bank size determine bank profitability in

Malaysia. For macroeconomic variable, inflation exhibits a positive and significant

relationship with the return on asset (ROAA), indicating that economic condition play

a role in influencing bank profitability in Malaysia. The results offer important policy

implication; it is evident that bank capital plays important role in banking sector not

only to increase profitability, but also acts as a line of defence against risks of failure

particularly during the crisis period. Malaysian banks should adhere to international

standards (Basel III) in order to remain strong in facing the challenging economic

environment nowadays.