Family Ownership and Earnings Management in Malaysia

Keywords:

accrual earnings management, real earnings management, family ownership, earnings ManagementAbstract

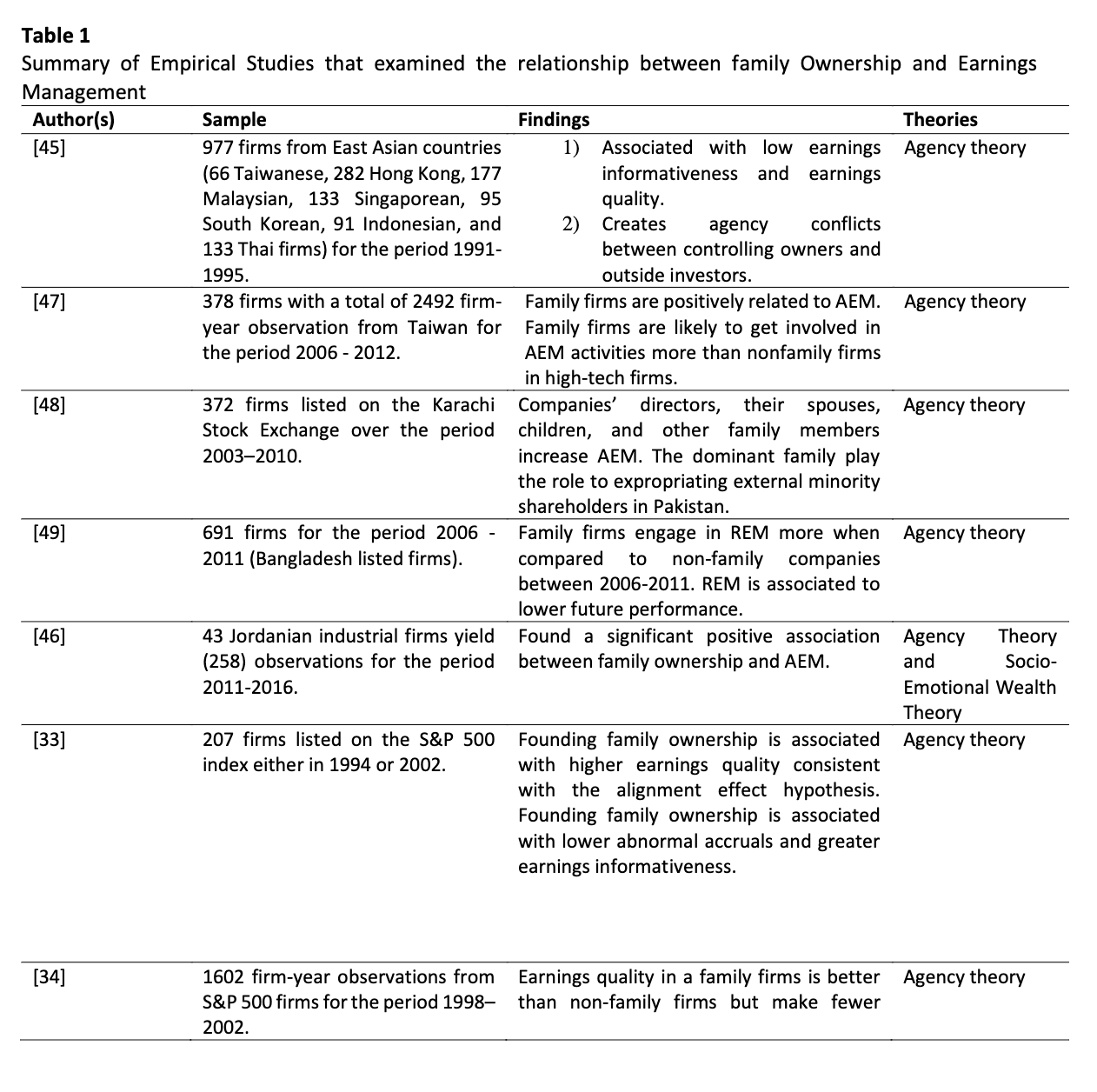

This paper proposes a conceptual framework to investigate the role of family ownership for mitigating earnings management (accrual & real). Family ownership is among the corporate governance primary mechanisms that have been a focus of many researchers and scholars. The present study argues that firms with family ownership are less likely to allow earnings management because they have typically invested a lot of their private fortune in the firm and families are more concerned about the survival of the firm and its reputation; thus, they have a strong motivation to monitor management very well. Despite that, there is a lack of prior studies that examine these relationships in developing countries. So, the main objective of this study was to bridge this gap and try to enrich the existing literature.