Risk Management Committee and Real Earnings Management through Sales: Evidence from Nigeria

Keywords:

real earnings management, independence directors, abnormal production cost, risk management committeeAbstract

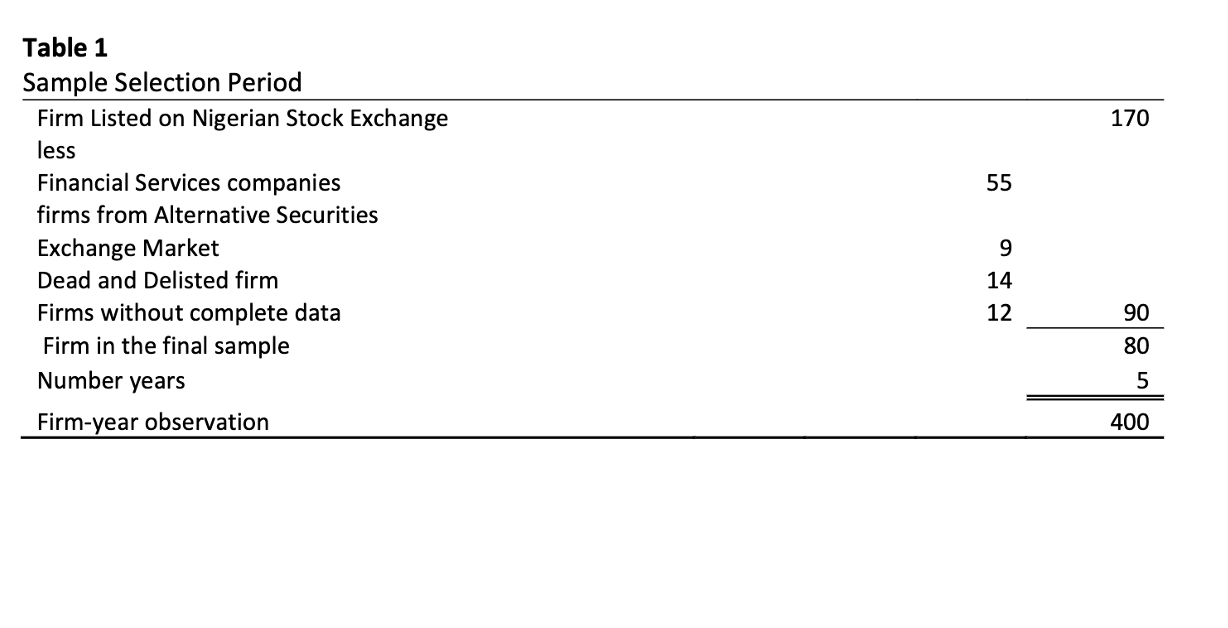

This study examines the impact of risk management committee on real earnings

management through sales manipulation of listed companies in Nigeria. The analysis

is based on a sample of 80 listed non-financial firms for the period of five years (2012-

2016), making up 400 firm-year observation. The data was extracted from the annual

report of the sample firms and Thompson Reuters database. Panel corrected standard

error regression (PCSE) was employed. The results show that risk management

committee (RMC) and independence directors reduce the management desire to

manipulate the reported earnings. The study informs the regulators on the needs for

firms to set up an independent RMC to restrain management from manipulating the

real earnings activities through sales.