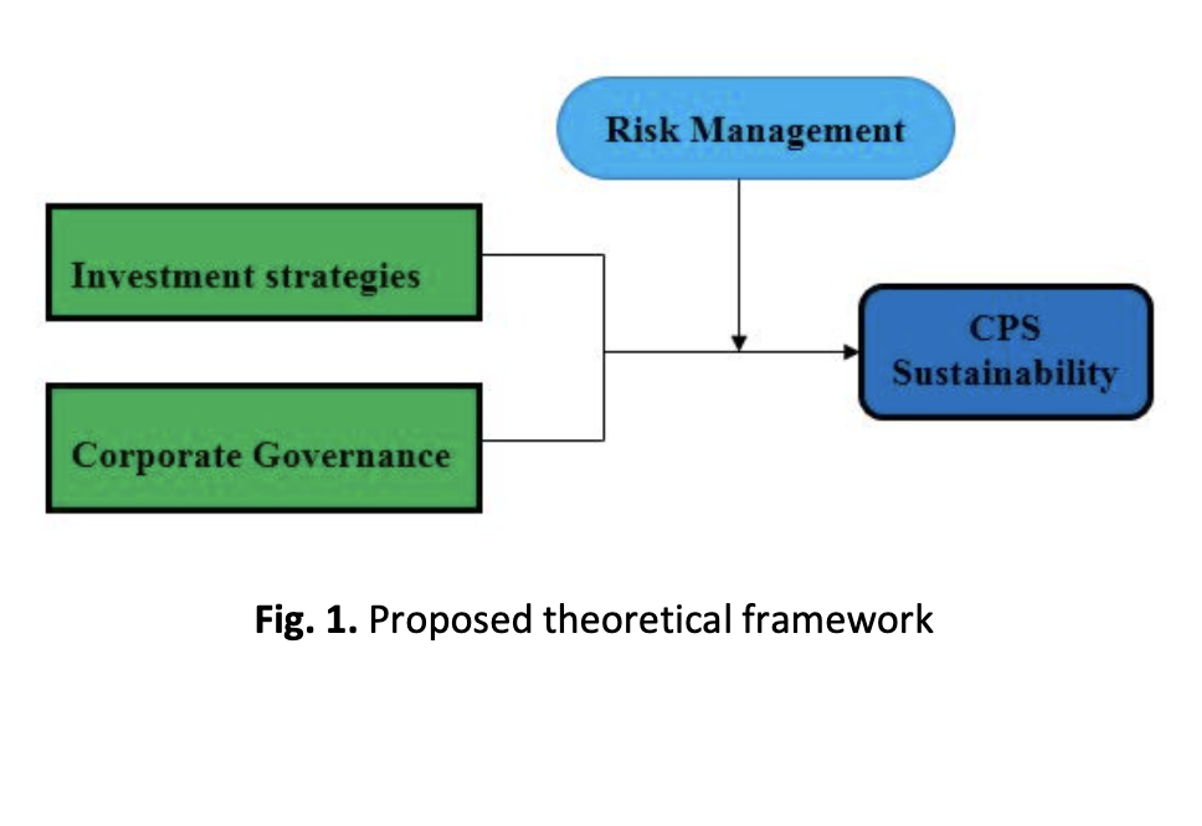

A Proposed Framework of Corporate Governance and Investment Strategy Impacts on Occupational Pension Sustainability: the Moderating Effects of Risk Management

Keywords:

corporate governance, investment strategies, risk management, sustainabilityAbstract

Based on Bank Negara financial stability and payment report (BNM, 2017), Malaysian economy is facing high household debt to GDP ratio, which is more than 70 percent since 2010 to 2017. A disturbing fact on this ratio indicates that the average Malaysian households is carrying debt more than two third of their income. For Islamic banks in Malaysia in particular, the report on the financial statements indicates that on average, almost 53 percent of their financing portfolio goes to household sector, out of which, half of the default rate is from the household sector. Hence, this paper empirically examines the determinants of household debt default of Malaysian Islamic banks. The current study attempts to explore the impact of selected bank specific factors on household nonperforming financing from year 2006 to 2016. Previous research in this area employed survey method on individual customer level. In this paper, we studied household debt default at bank level due its precarious impact on banks’ performance. By utilizing panel data analysis, our result from fixed effect regression finds that household default rate decreases profitability of Islamic banks significantly. Household financing growth and household debt default lag are found to positively impact the Islamic banks’ current year household debt default. This result implies that Islamic banks should diversify its financing portfolio to various economic sectors with lesser concentration in household sector to reduce their overall credit risk.