Trust as Moderating Variable in the Relationship between Fairness Perceptions and Voluntary Tax Compliance in Nigeria: A Theoretical Framework

Keywords:

voluntary, tax, trust, income, compliance, fairness perceptionsAbstract

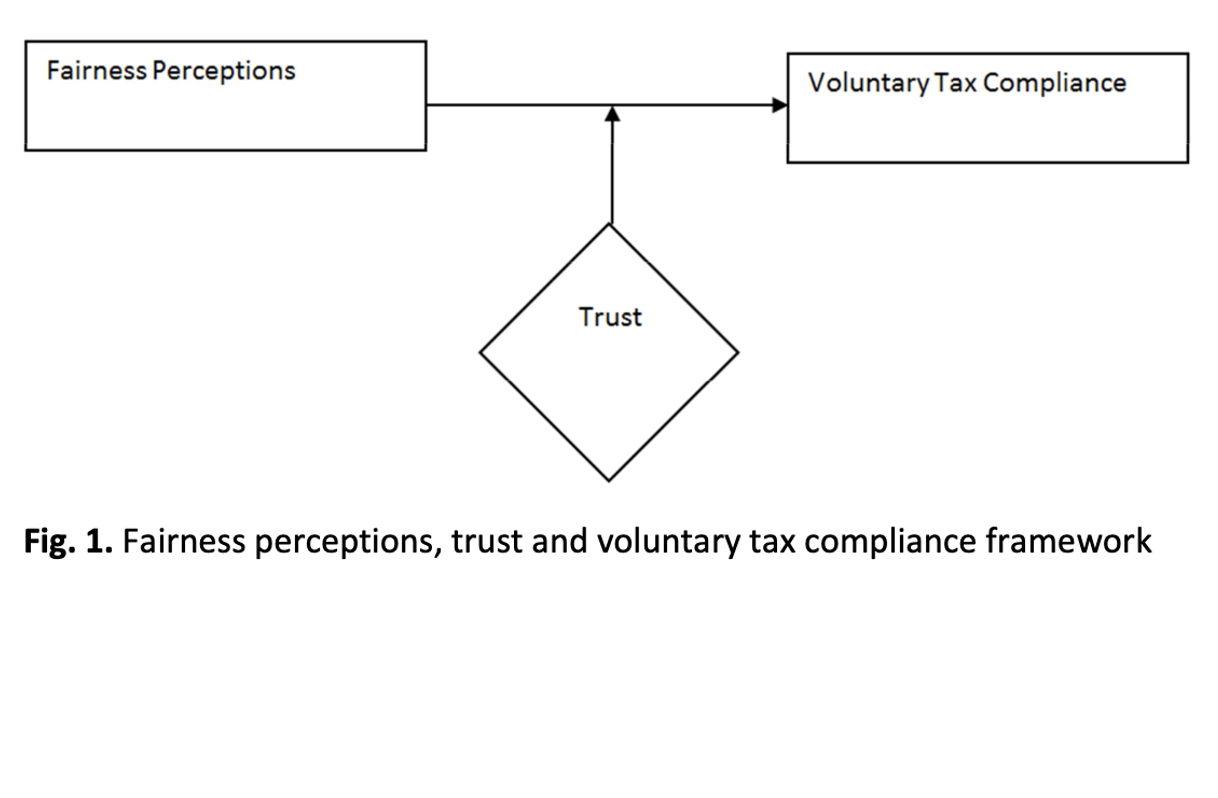

This paper presents a theoretical framework on the moderating effect of trust in the

relationship between fairness perception and voluntary tax compliance in Nigeria.

The variables proposed under examination are fairness perceptions; trust in authority

and voluntary tax compliance. If validated the model would have significance

important policy implications to the Nigerian government and other stakeholders.

The model would also serve as a basis for reference to other researchers willing to

undertake study in the same area.