Malaysian Islamic Banks Performance vs. Internal and External Characteristics

Keywords:

Islamic banks, bank performance, bank external characteristicsAbstract

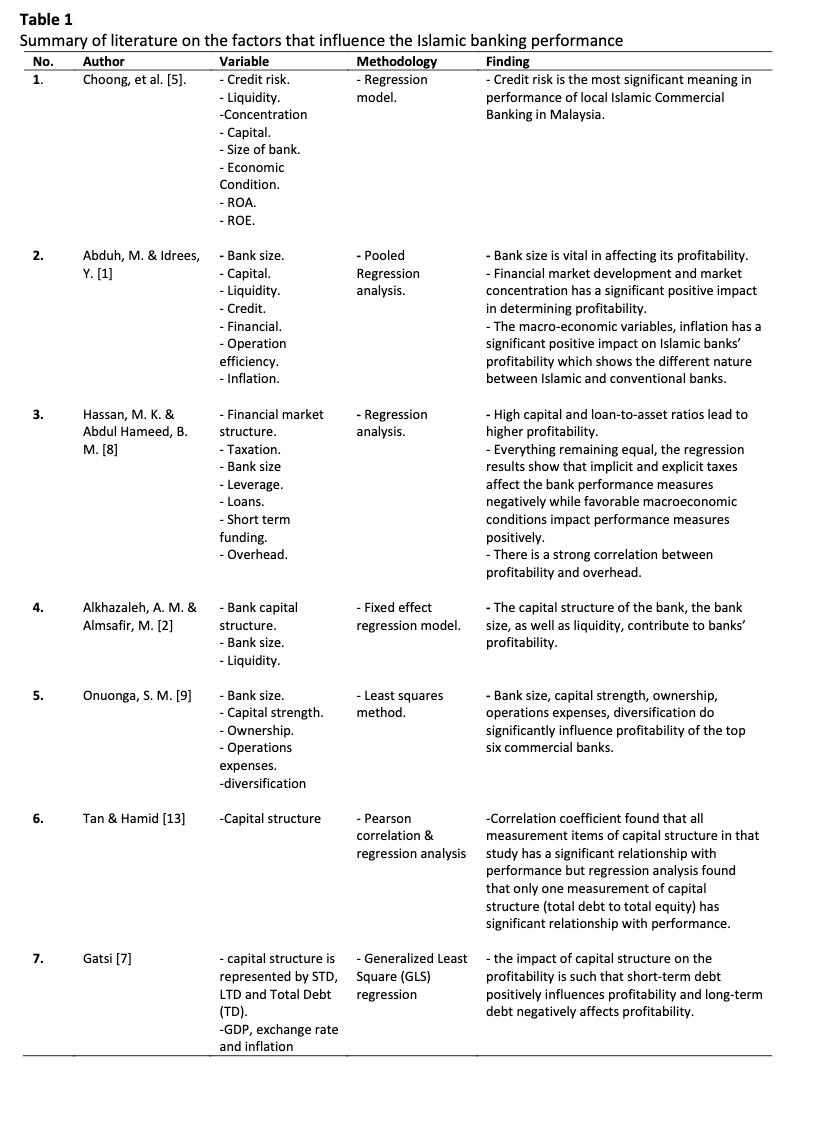

The inclusion of global financial markets has put Islamic banks in an intense competition with traditional banks. So, in order to compete in domestic and worldwide deposit markets, this research helps the Islamic banks in order to draw and initiate acceptable instruments that could cope with the remains innovations in financial markets. Specifically, the main purpose of this research is to measure the relationship between the performance among Islamic bank in Malaysia for the time period of 2011 to 2015 and its characteristics, by differentiate both the internal and the external characteristics. Risk Return Theory and Signalling Theory were applied to predict the relationship between the bank characteristics and its performance. From the regression model, the study has found that there was a moderate correlation between internal factors and profitability of Islamic banks in Malaysia. It was also found that there was a positive moderate relationship between the external characteristic and the financial performance among the Malaysian Islamic banks. The findings indicate that Islamic banks should invest in other lines of business such as product diversification and investments to stimulate their stability and contribute to profitability. These findings may enable the managers of the Islamic bank to make the right decision in order to generate outstanding outcomes and supports the bank regulators to make the right option in conducting Islamic banking operation systems.