The Effects of Behavioural Factors in Investment Decision Making at Pakistan Stock Exchanges

Keywords:

market factors, overconfidence factor, anchoring factor, prospect factors, behavioural factors, investment decision makingAbstract

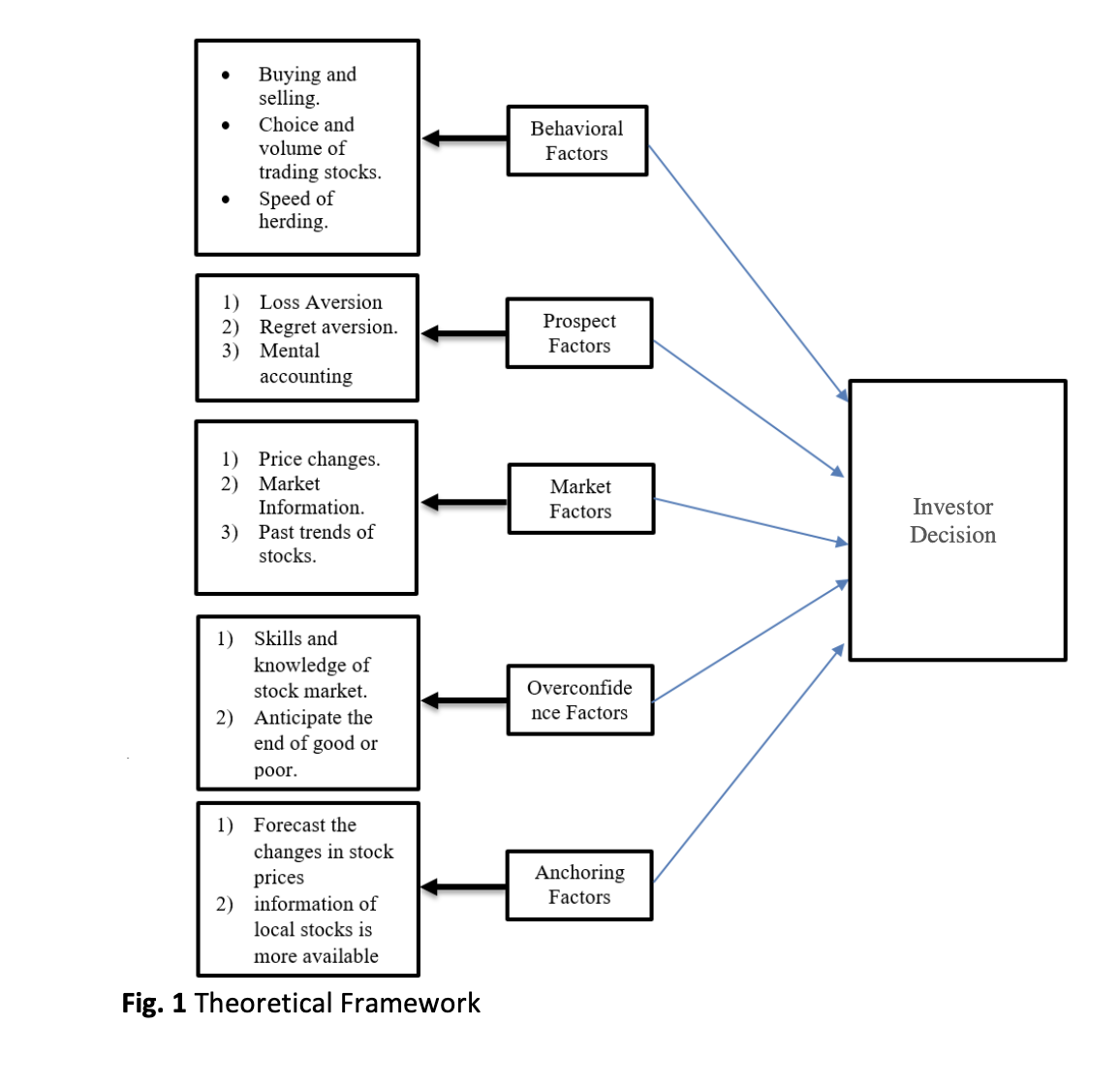

The present study is an endeavour to investigate the effect of behavioural elements such as Market Factors, Overconfidence Factor, Prospect Factors, Anchoring Factor, and Behavioural Factors on individual investors and institutional mangers in the stock exchanges of Pakistan. The study collected response from 50 equity managers of investment banks and investment companies that invest in Islamabad, Karachi and Lahore Stock Exchanges via adapted questionnaire. The individual investor plays a vital role in the stock market because of their good savings. The regulators of the stock market cannot ignore the behaviour of individual investors. Many individuals find investments to be fascinating because they can participate in the decision making process and see the results of their choice. Not all investments will be profitable, as investors’ whims not always result in fruitful returns. Recent studies on the behaviour of individual investors’ have shown that investors do not act in a rational manner. Several behavioural factors influence their investment decisions in stock markets. The current study practiced descriptive statistics, reliability, regression and correlation analysis. Investment triumph fits with best approach to investment decision making not with irrational investment behaviour on instant accessible information. Behavioural finance has given a unique opportunity to explore the effects of behavioural factors on investment decision-making process. The outcomes of the study exhibit that independent variables i.e. Market Factors, Overconfidence Factor, Prospect Factors, Anchoring Factor and Behavioural Factors is important for dependent variable Investment Decision Making.