Moderating Effect of BSN Banking Agent towards the Financial Inclusion Performance of BSN: A Conceptual Overview

Keywords:

financial inclusion, banking beyond branches, operation and compliance, BSN banking agentAbstract

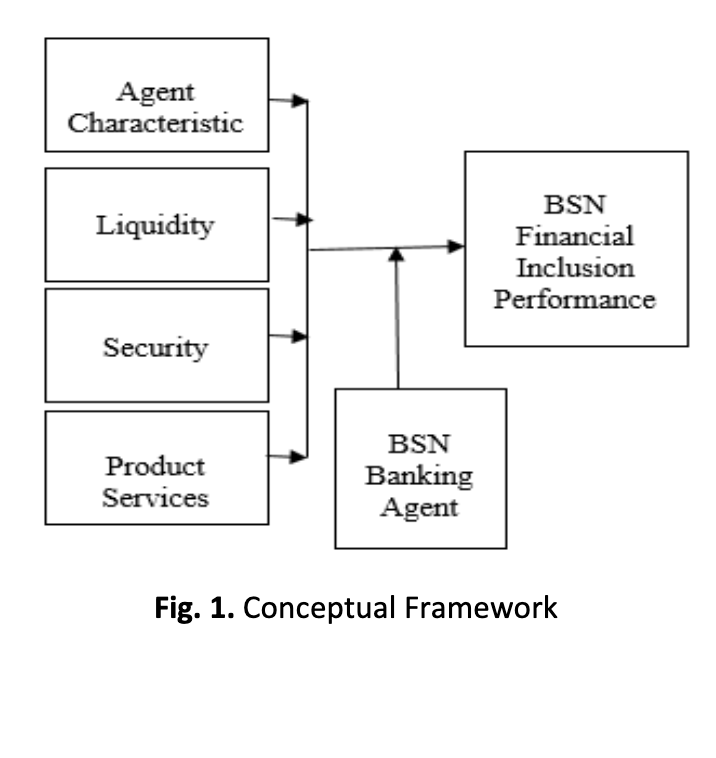

This paper conceptualizes the moderating effect of BSN Banking Agent towards the Financial Inclusion Performance of BSN. Based upon the Agent theory, it highlights on the four related variables namely: agent characteristics, liquidity, security and Product Services and the relation amongst the variables in focus that contributes to promising business performance. Hence, an ability to conceptualize, observe and give due recognition to the possible relation amongst these variables in question by the prospective employees of BSN in Malaysia in three departments which are: Banking beyond Branches, Operation and Compliance as they are allies directly with the agents. With recruiting the agents could bring an insightful engagement for the betterment of the financial inclusions business performance of BSN.