The Moderating Effect of Probability of Detection on the Determinants Influencing Excise Duty Non-Compliance in Malaysia

Keywords:

tax non-compliance, excise duty, illegal trade, smugglingAbstract

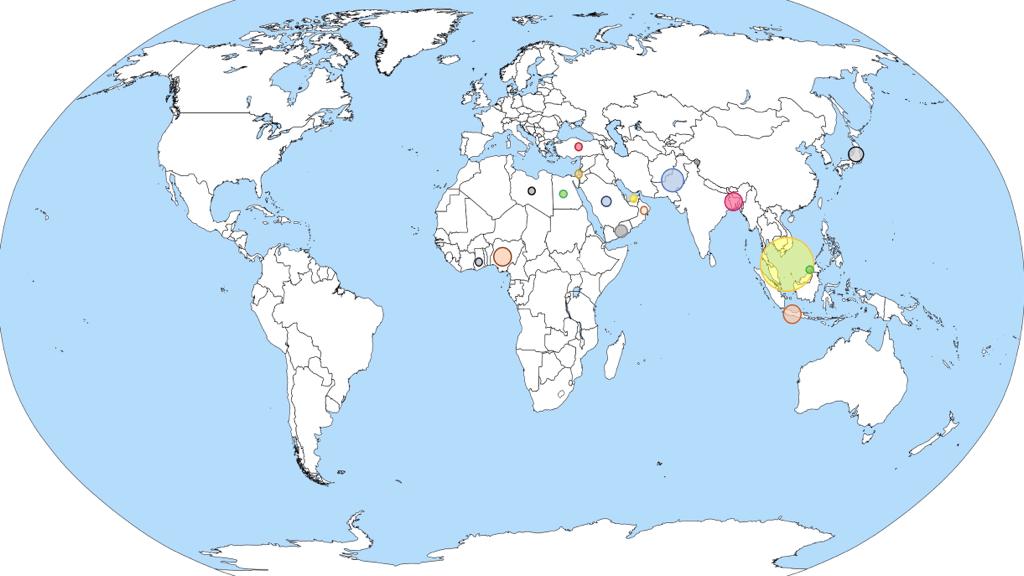

Tax non-compliance in indirect taxes involving importers as taxpayers in smuggling and

illegal trade activities for cigarettes, liquor and imported vehicles exists as a complex

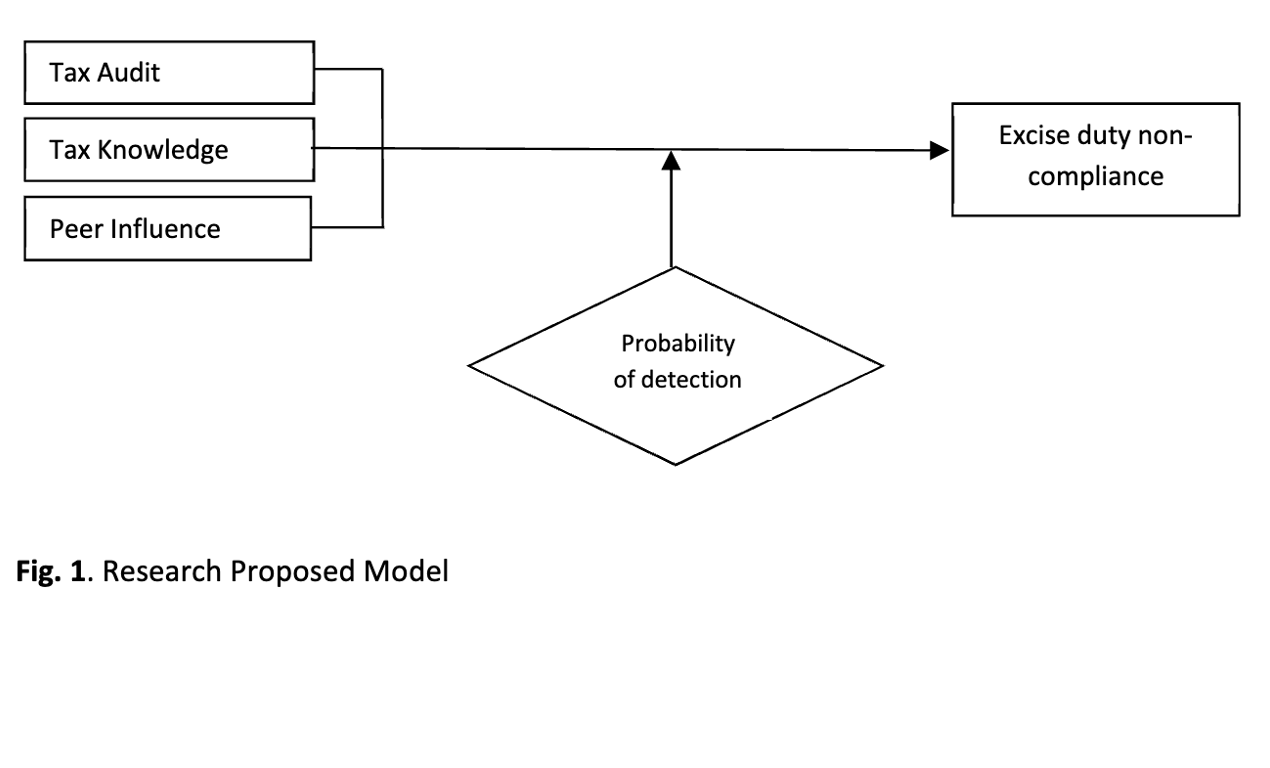

phenomenon in Malaysia. The purpose of this study is to examine the direct

relationship and probability of detection as moderator with tax audit, tax knowledge

and peer influence as independent variables to determine excise duty non-compliance

issue. The questionnaires were distributed using disproportionate stratified simple

random sampling technique. A total of 500 useable questionnaires collected for

analysis. The partial least square analysis applied to analyze the data. Analysis of data

involved throughout Malaysia indicates the tax audit, peer influence and tax

knowledge have a significant positive relationship. In addition, tax audit have

significant negative relationship and tax knowledge have significant positive

relationship with moderating effect. The findings from this study provided an

indication for the tax administration in maximizing tax collections and encourage

taxpayer’s compliance.